Stock dollar cost averaging calculator

Its almost impossibleeven for professional stock. Excluding the London Stock Exchange you will pay 025 of your entire portfolio value up to 250 each year for the connection fees.

Dollar Cost Average Calculator Returns Nerd Counter

Over the very long run the stock market has had an inflation-adjusted annualized return rate of between six and seven percent.

. The dollar cost averaging calculator UK is very beneficial. Are through the roof. 000 positions and transactions for home market NASDAQ.

Initial Investment Amount. Get the latest headlines on Wall Street and international economies money news personal finance the stock market indexes including Dow Jones NASDAQ and more. Of which you want to put 100000 into stocks such as a low-cost and diversified total stock.

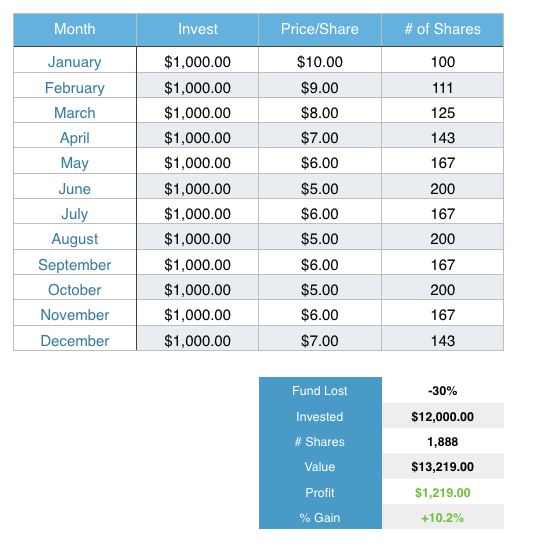

Dollar cost averaging is our preferred normal style of investing where you invest on a regular basis. Calculators and definitions of investing terms. Recurring Investment Amount.

Use the dollar cost averaging DCA calculator from Merrill Edge to find a DCA investing strategy that works for you. Averaging 23 a year over that 12-year period. The ETF return calculator is a derivative of the stock return calculator.

Also see our compound annual growth calculator Graph. While stocks have certainly beaten inflation over the long run theyve done poorly within the high-inflation periods themselves. However the capex run-rate has remained well ahead of earlier estimates of Rs500bn-600bn over FY21-FY22 averaging more than Rs1trn and touching an all-time high of Rs145trn for FY22.

That means making purchases of a set. Be informed and get ahead with. Determine how much your money can grow using the power of compound interest.

Investing a set amount of money in the stock market at regular intervals is often a good strategy. Compare the numbers above with the average stock mutual fund on an asset-weighted basis which charged 047 percent or the average stock ETF which charged 016 percent. Our estimate to the annual percentage return by the investment including dollar cost averaging.

The value of the stock investment over time. Source and Methodology of the Exchange Traded Fund Total Return Calculator. Note if you are on desktop you can drag over the graph to see the value of the portfolio on any day.

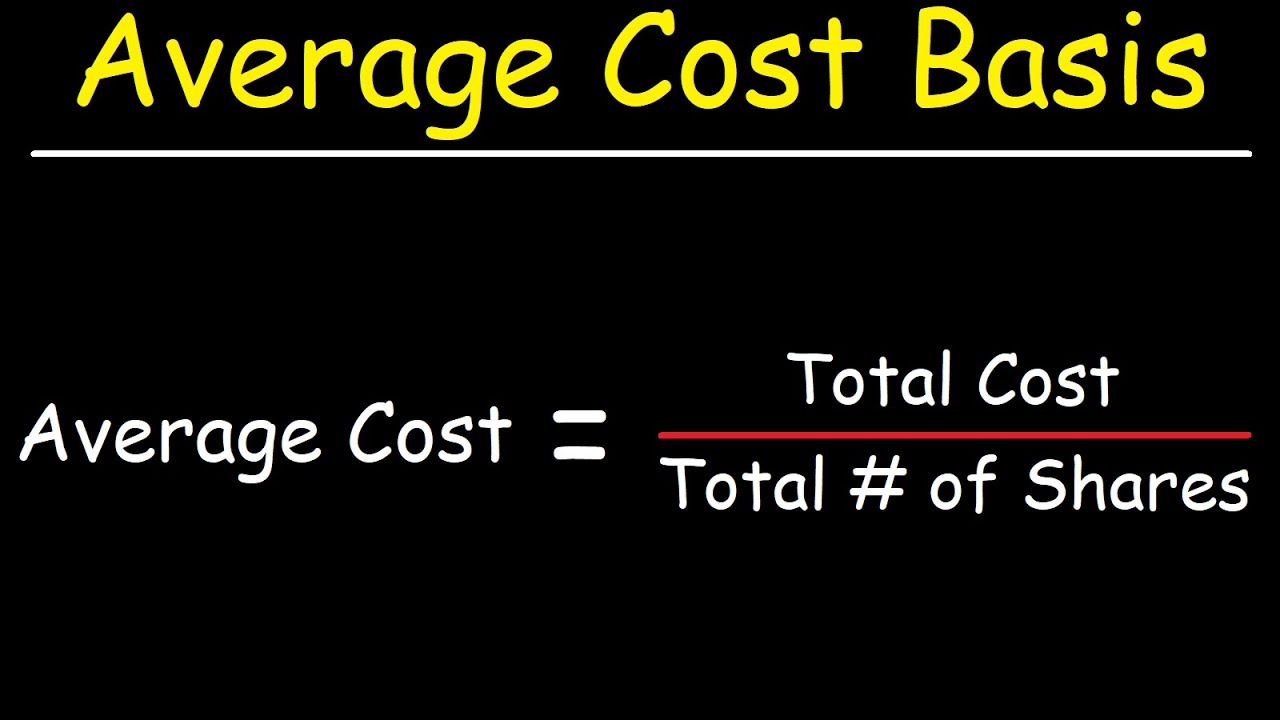

The average investment over time is equal to the. Learn the relationship among the cost of living the governments Consumer Price Index inflation and Americans household incomes. Articles and interactive features that explain finance and investments in Roth IRA stocks and bonds.

Dollar cost averaging is a strategy that can help you lower the amount you pay for investments and minimize risk. The median home price is more than 400000 as surging demand and record-low interest rates over the last two years propelled housing prices higher by. With Merrill Edge SelfDirected get unlimited free online stock ETF and option trades with no trade or balance minimums Footnote double asterisk.

Futures and options are the main types of derivatives on stocks. Stock futures are contracts where the buyer is long ie takes on the obligation to buy on the contract maturity. When the market is in turmoil the safest way to go on a buying spree is to dollar-cost average your purchases.

A classic example of this would be a 401k. A stock derivative is any financial instrument for which the underlying asset is the price of an equity. This investor will invest the same amount every time he.

Home prices in the US. Dollar-Cost Averaging With dollar-cost averaging an investor sets aside a fixed amount at regular intervals regardless of other circumstances. Opportunity cost on investment is the dollar amount of foregone returns from not investing elsewhere and is calculated by averaging investment over time and multiplying it by an interest rate.

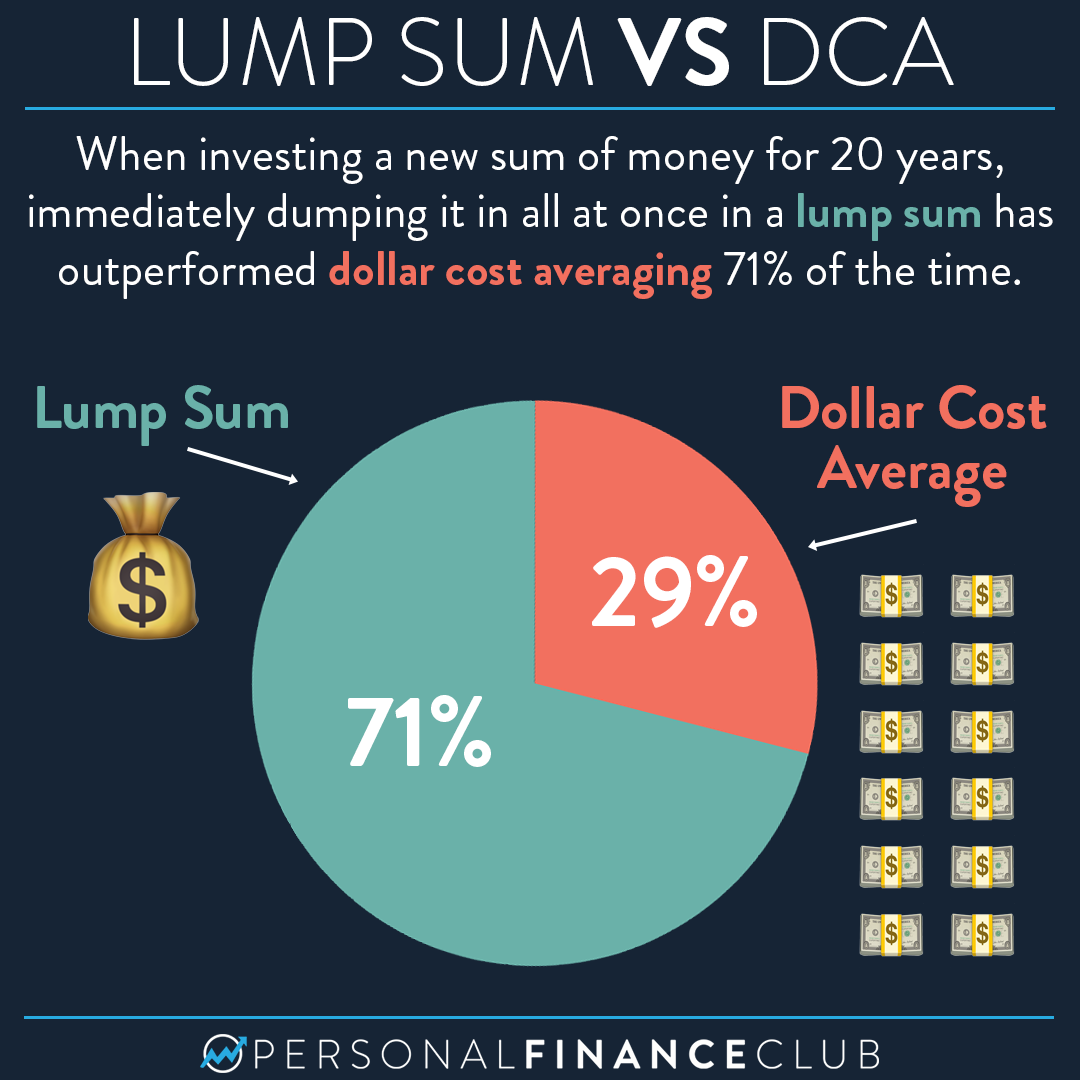

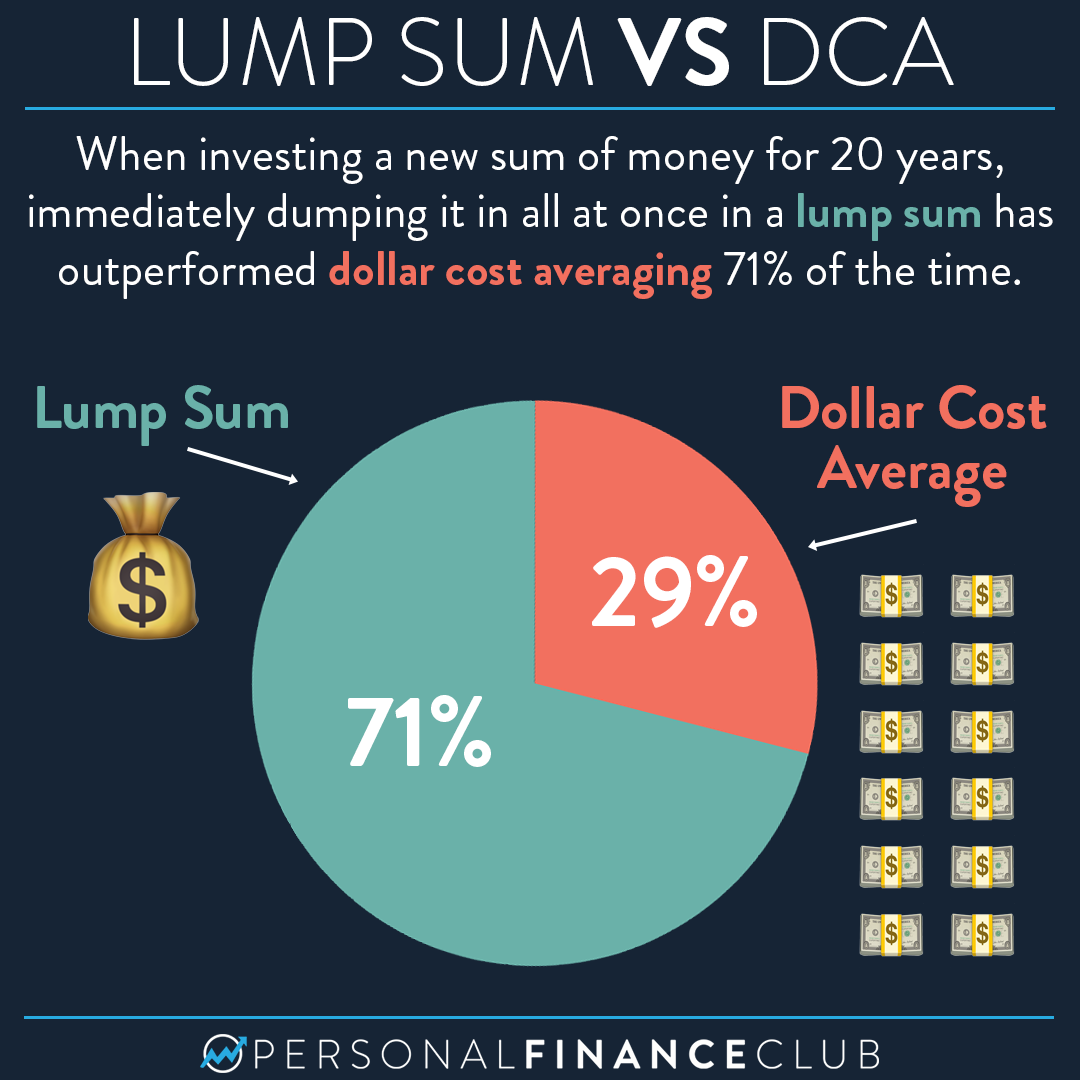

Dollar-Cost Average Even on the Way Down. Much of the. For periodic windfalls you receive we prefer investing the lump sum all at once.

You can use the calculator below for the dollar cost average plan for any stock by just entering the stock symbol. 250 transactions Euronext Derivatives. Is whether to invest a large amount in the stock market immediately or to do it over time through a method known as dollar cost averaging DCA.

Try the inflation-adjusted returns for 1916-1918 1946-1947 and 1973-1981. The underlying security may be a stock index or an individual firms stock eg. Trade Easier on Forex Gold WTI Brent Oil SP500 Nasdaq100 Facebook Apple Amazon and more than 80 trending markets with TOP1 Markets.

Value Averaging Spreadsheet Aaii

How To Calculate Your Average Cost Basis When Investing In Stocks Youtube

Dollar Cost Averaging And Reverse Dollar Cost Averaging Robert Gordon Associates Inc

Dollar Cost Averaging Manages Risk But Reduces Returns

Stock Total Return And Dividend Calculator

Dollar Cost Averaging Dca Investing Strategy In Stock Market

Dollar Cost Average Calculator Returns Nerd Counter

Dollar Cost Averaging A Passive Stock Investment Strategy Youtube

Average Down Calculator Free Template Youtube

What Performs Better Lump Sum Investing Or Dollar Cost Averaging Personal Finance Club

Dollar Cost Average Calculator Returns Nerd Counter

Lump Sum Vs Dollar Cost Average Calculator Personal Finance Club

Dollar Cost Average Calculator Returns Nerd Counter

How Dollar Cost Averaging Can Power Your Crypto Investing Strategy Nextadvisor With Time

Dollar Cost Averaging Manages Risk But Reduces Returns

Value Averaging Spreadsheet Aaii

Dollar Cost Averaging And Reverse Dollar Cost Averaging Robert Gordon Associates Inc